Understanding How

30D Capital Works

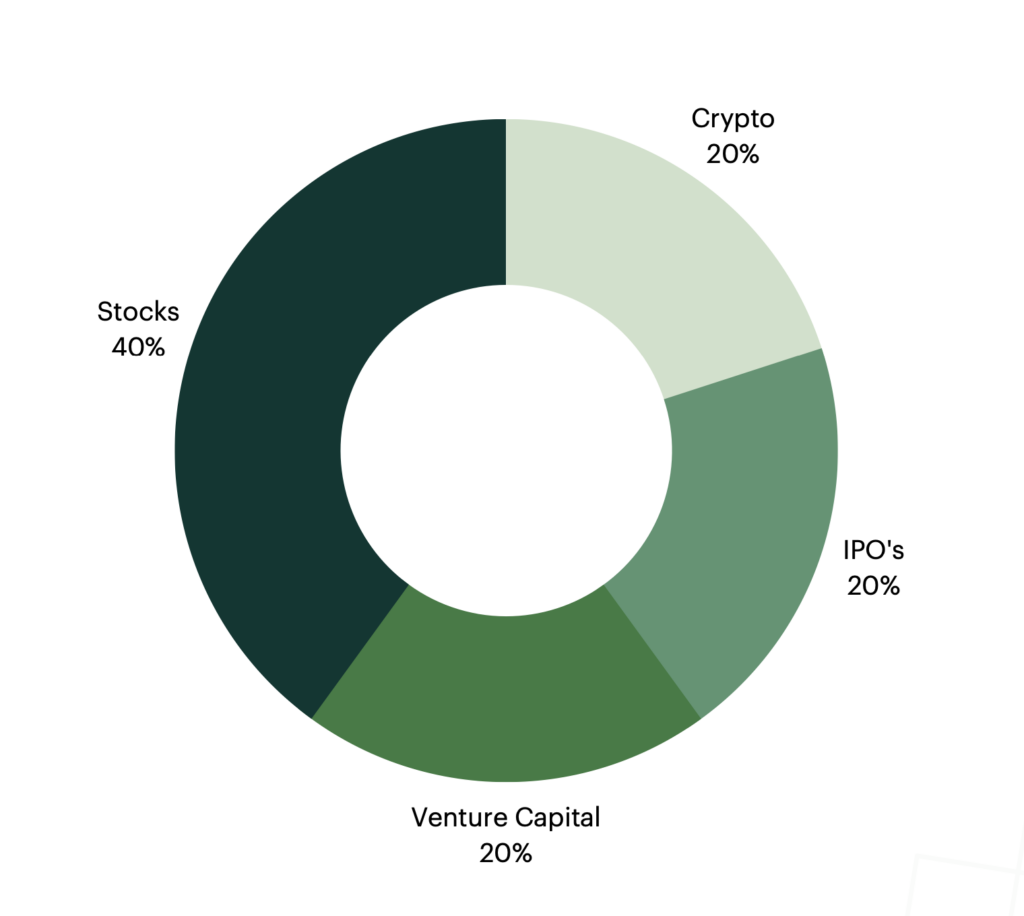

Our philosophy revolves around carefully allocating capital across different asset classes to achieve optimal growth while maintaining stability. Our diversified approach allows to tap into a range of opportunities, each with its own potential for returns.

Our focus lays on Stocks, Crypto, IPO's and Venture capital.

Stocks

In the stock investment landscape, we balance stability and growth by dedicating 40% of our portfolio to established companies, including blue-chip and growth stocks across diverse sectors. This strategy leverages market trends for your benefit while mitigating risk through diversification.

We conduct thorough analyses of global stock markets to select companies with strong growth potential in four key industries: Big Tech, Automation, Energy (focusing on renewables), and Biotech. This approach aligns with market movements and positions your portfolio to capitalize on the growth and innovation driving these sectors forward, ensuring both stability and growth potential.

Crypto

The world of cryptocurrencies is something we passionately embrace, hence why we are dedicating a significant portion of our strategy to harness its potential. The power of digital currencies will revolutionize finance, offering decentralization, security, and accessibility on a global scale.

Our approach blends the agility of short-term trades with long-term prospects, powered by AI technology. This method allows us to navigate the volatile crypto market effectively, aiming for optimal profit while managing risk.

The reasons for our strong belief in cryptocurrencies include their foundational blockchain technology, which ensures transparency and efficiency, and the growing mainstream acceptance that signals their enduring potential. Innovations such as DeFi, NFTs, and smart contracts further highlight the sector’s versatility and promise for extensive application across various industries.

Venture Capital

We’re passionate about fuelling startups with revolutionary ideas across various sectors or startups that need funding to scale, we’re committing 20% of our assets towards nurturing these pioneers. Our rigorous research process is designed to identify and support ventures with the capacity to disrupt existing markets and catalyze growth.

We believe in nurturing these companies not only for their individual success but also for the positive impact they can have on industries and society as a whole. Through strategic investments and continuing support, we strive to be at the forefront of driving innovation and shaping the future landscape of business.

IPO's

Initial Public Offerings (IPOs) harness the growth potential of early-stage companies. We dedicate 20% of our portfolio to carefully selected IPOs of promising companies on the rise of significant transformation. IPO investments present an opportunity to invest in businesses at the start of a big launch. The “pre-IPO” phase denotes the period when a company is gearing up for its market debut, yet to be publicly listed, often seeking investment to fuel its growth, an area where 30D Capital plays a pivotal role.

Our active engagement in IPOs involves investments in companies at both the IPO and pre-IPO stages, frequently securing minority ownership before these companies make their public appearance. This strategy allows us to capitalize on the public market’s reception of these companies, selling our shares post-IPO for a profit when the companies demonstrate strong market performance. Through this approach, we aim to leverage the inherent risk-reward profile of IPO investments, positioning our portfolio to benefit from the dynamic growth of these emerging market players.